Child and Dependent Care Credit: Definition, Who Qualifies

Dec 20, 2024 By John Davis

For those with children, the Child and Dependent Care Credit may be an area of personal finance to consider when filing taxes. This special credit is designed to help families and individuals with certain dependent care expenses—filing can sometimes provide substantial tax relief for these costs.

This article will discuss the definition of the Child and Dependent Care Credit, who qualifies for it, and some tips for completing your return if you are eligible. Read on to learn more about maximizing your tax refund based on these important criteria!

What is the Child and Dependent Care Credit (CDC)?

A tax credit known as the Child and Dependent Care Credit (CDC) is offered to eligible taxpayers who support one or more eligible individuals. While you work or hunt for work, the credit can help defray the cost of nursery for adults, children, and other qualifying care services.

Who Qualifies for the CDC Credit

The Child and Dependent Care Tax Credit is available to individuals who are paying for the care of a qualifying individual to work or look for work. To qualify, the person receiving care must be either:

1) A dependent child who is under 13 years old at the end of the tax year,

2) A spouse who is not capable of self-care, or

3) Any other dependent you claim on your taxes who is physically or mentally incapable of self-care.

The care person must be a professional caregiver, such as a babysitter or daycare provider. The cost of the care must also be reasonable relative to the

- How many children can qualify for the credit

- What are the income limits for this credit

service being provided. Additionally, you must have earned income during the tax year to qualify for the credit. The credit is limited to a percentage of the amount paid for qualifying care, and there are limits on the income of those who qualify. The exact income limits vary based on filing status and other factors, so it’s important to research your eligibility before you file.

How Much Can Be Claimed on this Tax Credit

The Child and Dependent Care Credit allows individuals to claim up to 35% of their eligible expenses, with a maximum of $3,000 for one qualifying individual or $6,000 for two or more qualifying individuals. For example, if an individual has qualified expenses of $4,000 for the year, they will receive a credit equal to 35%, or $1,400.

It’s important to note that only a portion of the total eligible expenses may be claimed; typically, no more than $3,000 for one qualifying individual and no more than $6,000 for two or more qualifying individuals.

This means that if an individual had qualified expenses totaling more than the allowable amount, they can still only claim a maximum of $3,000 or $6,000 for two or more qualifying individuals.

The Child and Dependent Care Credit is a non-refundable credit which means that it can reduce your tax liability to zero, but any excess amount cannot be refunded to you. However, if you cannot use the full credit in one year, it can be carried forward and used the following year.

Requirements and Restrictions When Applying for the CDC Credit

The Child and Dependent Care Credit is a tax benefit offered to those who pay for child care or dependent care expenses. It helps offset childcare costs to help make it financially feasible for parents and other taxpayers to be able to work or look for employment.

To qualify, you must meet certain requirements:

- To be able to work or look for job, you (and your spouse, if filing jointly) must have paid for child care costs.

- The child or other dependent must have been under 13 when care was provided or have a physical or mental disability.

- The care person must not be your spouse, parent, tax filing partner, or any dependents listed on the return.

It is important to note that you may only claim childcare expenses for one person. If your spouse works and pays for childcare expenses, then they must be the ones to claim the Credit on their return, not jointly on a combined return.

Examples of Eligible Expenses

The Child and Dependent Care Credit covers eligible expenses related to the care of a qualifying individual. These include:

- Nursery school or preschool fees

- Expenses for the care of an in-home nanny, au pair, or another caregiver

- Fees charged by a daycare center, summer day camp, or other care facility

- Expenses for overnight camps (for children under age 13)

Other Benefits Associated with this Tax Credit

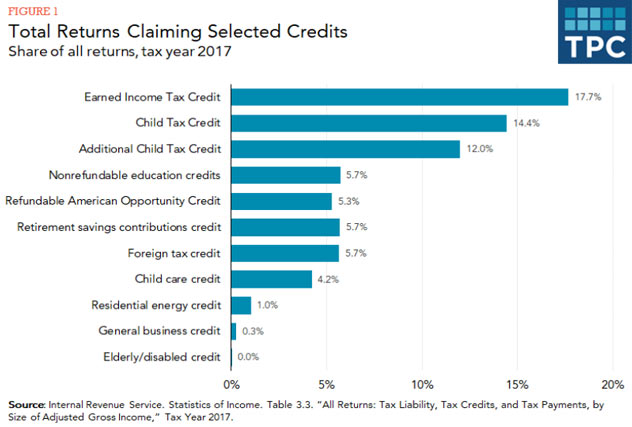

The Child and Dependent Care Credit is connected to benefits like the Earned Income Tax Credit. If you don’t qualify for the full credit, you may still be eligible for a reduced amount of the Child and Dependent Care Credit.

The Earned Income Tax Credit is designed for low-income families with children under 17 years old. If you qualify for the Earned Income Tax Credit, there’s a good chance you also qualify for the Child and Dependent Care Credit.

If you do qualify for both credits, filing your taxes may be simpler as the two tax credits are connected. You can combine the forms required to file these two credits into one form.

To determine if you qualify for either of these tax credits, use the IRS’s online tools or contact a qualified tax professional. Knowing whether or not you’re eligible to receive the Child and Dependent Care Credit can help reduce your taxes and make filing easier.

FAQs

What are the criteria for a dependent child?

The definition of a dependent child for this credit is any qualifying person who is either:

- Under age 13 and primarily living with you, or

- A disabled individual who qualifies as your dependent.

This could include a child, grandchild, stepchild, foster child, or adopted child. Sometimes, a sibling, parent, or other family member may qualify as your dependent.

What are dependent care benefits?

Dependent care benefits are the funds paid to provide services for a qualifying dependent or dependent child. This could include daycare, before and after-school programs, summer camps, and more.

Who can claim the reign tax credit?

You must be a US citizen or resident alien to claim the Child and Dependent Care Credit. You must also earn at least $1,000 for the credit to apply during the tax year. Additionally, you must not have received dependent care benefits from your employer that exceeded $5,000.

Conclusion

The above information helped you understand Child and Dependent Care Credit and who qualifies for it. This tax credit can significantly reduce your taxes if you meet the qualifications.

It’s important to note that eligibility can change yearly, so consult an accountant or tax professional before filing your taxes. This will ensure that you get the maximum benefit of this credit and that you’re not missing out on any savings.

Why You Should Grab a Gas Credit Card Today!

What Do You Need To Know About Gross Leases?

Is Your State Tax Refund Taxable

How To Figure Out The Deductible For Hurricane Insurance

Things You Need to Know About an Account Statement

Early Retirement: Strategies to Make Your Wealth Last

Top 5 Airlines Offering Refundable Plane Tickets

Early Withdrawal from Your Roth IRA: Pros and Cons

How to Choose the Right Home Warranty Company for Your Needs?