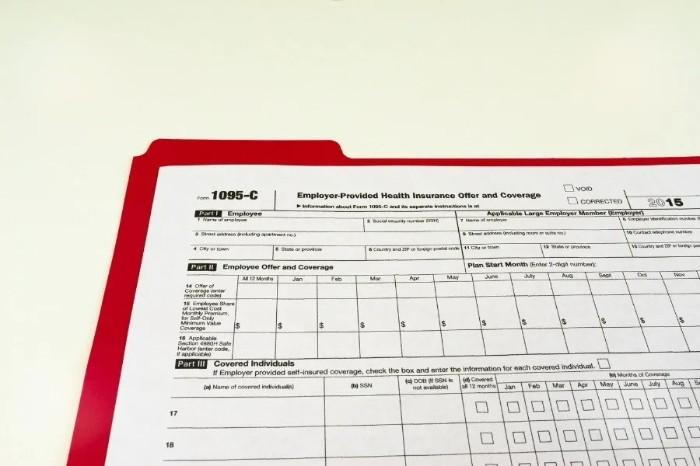

What Is Form 1095-C: Employer-Provided Health Insurance Offer and Coverage?

Nov 20, 2024 By Kelly Walker

Are you a business owner who provides employer-sponsored health insurance? If so, you must be aware of Form 1095-C and its obligations. You must understand how this form works to ensure that your company complies with all legal requirements regarding providing healthcare coverage.

In this blog post, we will discuss what Form 1095-C is and its role in employer-provided health insurance offers and coverage. Keep reading for more information about understanding the various documents related to employee benefits reporting.

Overview of Form 1095-C

Form 1095-C is a statement that employers must provide to their employees, who are full-time or part-time. It provides information about health coverage offered by employers and allows employees to report their health insurance status on their tax returns. The form includes details such as whether the employee was offered coverage, who the covered individuals were, and what plan the employer offered.

Employers must provide Form 1095-C to all full-time or part-time employees enrolled in a health care plan by March 2 each year. Employees not offered coverage should receive a Form 1095-C indicating no coverage is available.

Understanding the six components of Form 1095-C

Form 1095-C is an IRS form that employers must report if they offer health insurance as part of their benefits package. The information on the form helps the IRS verify whether or not individuals have received employer-provided health coverage and, in some cases, determine if they are eligible for a tax credit or penalty.

The form is divided into six components:

- Employer Information: This is the name and address of the employer, as well as their Employer Identification Number (EIN).

- Employee Information: The employee’s name and address, Social Security Number (SSN) or Taxpayer Identification Number (TIN), and the months for coverage.

- Employer Offer of Coverage: This section includes information about the type and level of health coverage the employer offers and any contributions they may have made to an employee’s premiums.

- Employee Eligibility: This section contains information about whether or not an employee is considered full-time, part-time, seasonal, or temporary and the months of coverage provided to them.

- Covered Individuals: This section includes information about individuals covered under the employee’s health plan (e.g., spouse, children, etc.).

- Certification Statements: This section contains statements that certify that the employer has provided health coverage to their employees.

Employers must provide Form 1095-C to any employee who received health insurance coverage during the year. The form must be sent out by January 31 of the following year and include all the information listed above. Failure to comply with IRS requirements can result in costly penalties, so ensuring all employees receive the form on time is important.

Benefits of the form

Form 1095-C is an important tax form employers use to report compliance with the Affordable Care Act (ACA) Employer Shared Responsibility provisions. Employers must provide this form to Pertinent large employers or employers with 50 or more full-time equivalent employees. The form allows employers to track and report whether minimum essential coverage was offered to full-time employees and their dependents.

For employers, Form 1095-C offers several benefits:

- It helps ALEs avoid potential penalties for not offering coverage to full-time employees. By reporting coverage offers and enrollment, employers can show compliance with the ACA.

- It provides documentation for tax filings. The form can be used as proof of coverage offered for tax purposes.

- It streamlines reporting processes. The form provides an official template for reporting coverage offers and enrollment, making it easier for employers to track and disclose this information.

Form 1095-C is an important reporting tool for large employers to monitor ACA compliance and facilitate tax reporting. While additional paperwork is required, the form offers a straightforward process for disclosing coverage offers and enrollment. With accurate and timely filing, employers can leverage the form to demonstrate compliance and support tax filings.

How to file Form 1095-C - step-by-step instructions for filing accurately and on time

Form 1095-C is an important tax form that must be filed by pertinent large employers (ALEs) to report information about the health coverage they offer or do not offer to their full-time employees. Accurate and timely filing of Form 1095-C is crucial to avoid significant penalties. Here are the key steps to filing Form 1095-C:

1. Determine if you are an applicable large employer. During the last calendar year, ALEs employed at least fifty full-time workers daily, including full-time equivalent workers.

2. Identify full-time employees. You must issue Form 1095-C to all your full-time employees. A full-time employee is at least 30 hours of service per week. You may also need to issue Form 1095-C to non-full-time employees offered coverage.

3. Report health coverage information accurately. For each employee, you must report whether minimum essential coverage was offered, the months it was offered, and whether the employee enrolled. This information must be reported accurately based on your records.

4. Prepare and distribute Forms 1095-C. You must prepare Form 1095-C for each full-time employee and distribute copies to employees and the IRS according to the applicable deadlines. Forms 1095-C must be distributed to employees by March 2 and filed with the IRS by March 31 for the prior year's coverage.

5. Respond to employee and IRS inquiries. You must answer employee questions or concerns about Form 1095-C within 30 days. You must also respond to any IRS questions or requests for additional information regarding your Form 1095-C.

By following these key steps and filing Form 1095-C accurately and on time, you can avoid significant penalties and comply with your reporting obligations under the Affordable Care Act. Please let me know if you have any other questions.

FAQs

What is Form 1095-C?

Form 1095-C is an IRS form employers must provide employees when offering health insurance coverage. It includes information about the employer’s offer of coverage, as well as employee eligibility and enrollment in a group health plan. Form 1095-C is due to the IRS by March 31 each year.

Do I need to file Form 1095-C?

If you are an employer offering health insurance coverage to your employees, you must file Form 1095-C with the IRS. Employers who fail to file or provide inaccurate information may be penalized and fined.

What information is included in Form 1095-C?

Form 1095-C includes six components: (1) employer contact information, (2) employee name and address, (3) type of health coverage offered and enrolled in by the employee, (4) start date of coverage, (5) number of months covered in a given year, and (6) whether or not the employer offered minimum essential coverage to employees.

Conclusion

In conclusion, Form 1095-C is an important document for employers to understand and file on time and accurately. Every component of the form holds value, from the employee's offer of health coverage information to employer-provided coverage and more.

Employers should remember that there could be penalties or fines if Form 1095-C is filed incorrectly. Further guidance is also available through IRS resources or qualified tax experts familiar with filing forms such as this one.

Best Student Loans for Bad Credit

How to Get a Mortgage Without a Job: 5 Tips for Success

Best Biotech ETFs

Form 9465: Installment Agreement Request

What Is Form 1095-C: Employer-Provided Health Insurance Offer and Coverage?

Avant Personal Loans Review

Revolving Credit vs. Line of Credit

Twitter Feeds Investors Should Follow

PNC points Visa Credit Card Review