How Is Margin Interest Calculated?

Nov 24, 2024 By Rick Novak

Do you understand how margin interest is calculated? It's a commonly asked question, but many people must learn to answer it accurately. We're here today – to explore this topic and ensure everyone knows what they need about margin interest calculations.

This blog post will help you better understand how your broker-dealer calculates the margin interest rate on your account and loan balance so that you can properly manage your finances and make informed decisions.

What Is Margin Interest and How Does It Work

Margin interest is the interest charged on the money you borrow from a brokerage firm to purchase securities. In other words, it's an extra cost added to your investment when you use borrowed funds. The amount of margin interest you pay is based on the current rate set by your broker and the amount of money you borrowed.

When you open a margin account, you must maintain a minimum required balance. This amount is usually the sum of the total purchase price plus any associated fees (e.g., commission). The total purchase price and fees are called the 'margin.' The broker may also require you to keep more money than the minimum in your account; this is a 'margin call.'

The interest rate charged on margin accounts can vary depending on the amount of money borrowed, the length of time you borrow it, and other factors. For example, longer-term loans may carry a higher interest rate than short-term loans. Additionally, some brokers may have different margin interest rates for different types of investments.

If you exceed the amount you borrowed, your broker can call a "margin call" and demand that you add funds to your account or sell some of your securities. If you don't comply with the request, the broker may liquidate your assets to cover the margin call.

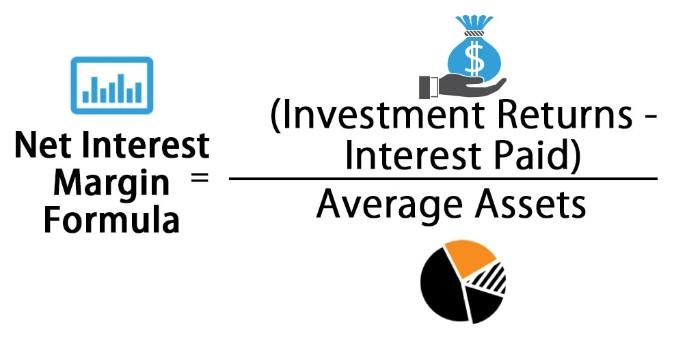

The Formula for Calculating Margin Interest

The formula for calculating margin interest can be expressed as follows:

MIR = (Balance x Interest Rate × Number of Days) / 365

MIR stands for Margin Interest Rate in this equation; the other variables are self-explanatory. This formula calculates the total interest due on a given margin account after a certain number of days.

It is also important to remember that interest rates are not static and, as such, can change over time. Therefore, staying current on margin interest rate changes and modifying calculations is important. Doing so will help ensure you know exactly what you owe and when.

By understanding how margin interest is calculated, investors can be more informed about the costs associated with their investments. With this knowledge, they can better determine which investments suit their financial goals.

Factors That Affect the Amount of Margin Interest Charged

The interest charged will depend on several factors when borrowing funds on margin. The most important factor is the margin rate your broker assigns to your account. This rate will vary depending on your account size and how long you plan to borrow funds. In addition, the current rate set by the Federal Reserve Board is used to determine the interest rate charged.

The amount of time you borrow will also be a factor in the amount of margin interest charged. If you borrow for an extended period, generally more than six months, the interest rate will be higher than if you only borrowed for a shorter period. In addition, the size of your loan and the amount you borrow will also affect the interest rate.

Finally, additional fees, such as a maintenance or setup fee, may be associated with borrowing on margin. It is important to check with your broker to ensure you understand these fees before signing up for a margin account.

The Difference between Margin Interest Rates and Other Loan Rates

Margin interest rates are different from other loan rates. Brokers and lenders charge margin interest on funds borrowed to buy securities, such as stocks or bonds. These loans typically require a minimum balance to be maintained in the account, known as the margin requirement.

The amount of interest you pay on a margin loan depends on several factors1. The rate set by your broker or lender

The interest rate is based on the U.S. Prime Rate, which can vary from one institution to another. Generally speaking, the interest rates are higher than those associated with other types of loans.

Benefits of Using a Margin Account

Using margin in your investments can provide a range of benefits, such as offering more buying power for larger transactions or giving you access to short selling. However, it's important to understand how margin interest is calculated before using this financial tool.

FAQs

How is interest charged on a margin loan?

Interest on a margin loan is charged at the rate set by your broker or lender, based on the U.S. Prime Rate. This rate can vary from one institution to another and is typically higher than other types of loans. The amount of interest you will pay is calculated using the formula: MIR (Margin Interest Rate) × Number of Days) / 365.

What factors affect the amount of margin interest charged?

The most important factor is your broker's margin rate to your account. This rate will vary depending on your account size and how long you plan to borrow funds. In addition, additional fees may be associated with borrowing on margin, such as maintenance.

What is the difference between margin interest rates and loan rates?

Margin interest rates are different from other loan rates. Brokers and lenders charge margin interest on funds borrowed to buy securities, such as stocks or bonds. These loans typically require a minimum balance to be maintained in the account, known as the margin requirement.

Conclusion

In conclusion, knowing how margin interest is calculated is important for any investor to effectively utilize its benefits. Based on the discussion above, it is easy to see that the margin interest rate and amount depend on various factors, such as the size of your loan and prevailing rates. Furthermore, investors should consider opportunities and risks associated with margin accounts before utilizing them.

How to Get a Mortgage Without a Job: 5 Tips for Success

Impact of Recoverable Depreciation on Financial Statements

Best Biotech ETFs

4 Ways to Remove Your Name Off a Cosigned Loan

Best Bloomberg Terminal Alternatives

What is a Like-Kind Exchange

What Is a Float-Down Lock in Mortgage Rates?

Why Not Buy Before the Dividend and Then Sell?

Criteria for Achieving Public Limited Company Status