Zero Interest Loans: Why You Should Beware

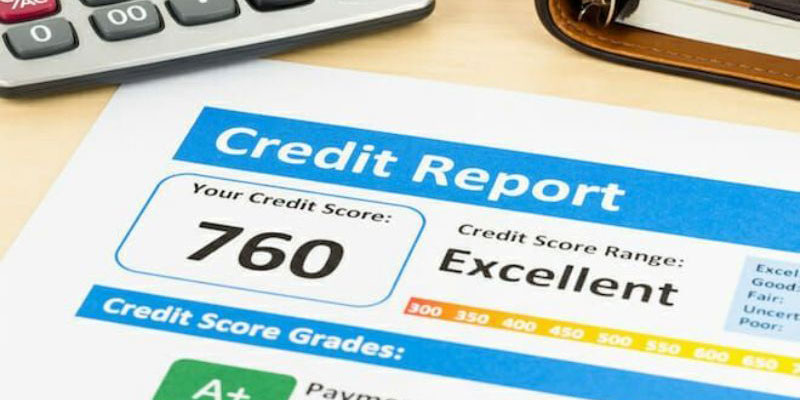

What are Top Personal Loans for Excellent Credit

Best Bloomberg Terminal Alternatives

What Is Debt Signaling?

Impact of Recoverable Depreciation on Financial Statements

Dec 27, 2024 By Rick Novak

Recoverable depreciation is an accounting term that describes the value a company has lost during its lifetime due to wear and tear, obsolescence, or other factors. It is often called "depreciation expense" or "accumulated depreciation." Recoverable depreciation can hurt a company's financial statements by reducing its profitability and weakening its financial position. Understanding how recoverable depreciation affects the financials of a business can help managers make more informed decisions when managing their finances.

What is Recoverable Depreciation?

Recoverable depreciation is the value a business has lost due to wear and tear or other factors. This can include physical assets like equipment, buildings, or vehicles and intangible assets like goodwill or website design.

How Does it Impact Financial Statements?

Recoverable depreciation can harm a company's financial statements. When expenses are more significant than income, the business will have lower net earnings and profitability than it would have had if recoverable depreciation was not considered. This is because when the value of assets decreases due to wear and tear or obsolescence, less capital is available to finance operations. In addition, this lowers the book value of a company’s assets, reducing its overall worth, as seen by investors.

How Does Recoverable Depreciation Affect Financial Statements?

The effects of recoverable depreciation on financial statements are far-reaching. It reduces the value of an asset over time and can result in lower net income figures for a company. This can affect specific financial ratios, such as return on equity (ROE), which measures how efficiently a company uses its shareholders’ equity to generate profit. In addition, recoverable depreciation can reduce the market value of a business if it is held for sale, making it less attractive to potential buyers.

The effect of recoverable depreciation on financial statements can be managed by accurately tracking the amount of depreciation over time. Regular maintenance and repairs to equipment or other assets can help reduce the effects of wear and tear while adequately managing intangible assets can ensure they remain valuable for the business. By monitoring their financials closely, managers can identify when recoverable depreciation has a significant impact and make necessary adjustments to minimize its effects.

The Benefits of Recoverable Depreciation:

Recoverable depreciation can be beneficial to a company in certain situations. For example, it can provide an income tax benefit when the value of an asset is reduced due to wear and tear or obsolescence in a particular period.

- This allows businesses to recover expenses incurred when purchasing or replacing new assets.

- By accurately tracking their depreciation expenses and monitoring their financial performance closely, companies can ensure they are taking advantage of all available tax benefits and maximizing their profits.

Examples of Recoverable Depreciation in Practice:

Recoverable depreciation can be seen in businesses of all sizes and industries. A typical example is the depreciation of physical assets, such as buildings, vehicles, or equipment. As these items wear down over time, their value decreases, and companies need to account for that decrease when filing their taxes.

Another example is the amortization of intangible assets, such as website design or software development. The cost of these types of investments can be spread out over several years depending on the type and age of the asset.

By accurately tracking recoverable depreciation and making necessary adjustments, companies can maximize their profits while taking advantage of available tax benefits.

Tips for Successfully Implementing Recoverable Depreciation on Financial Statements:

Successfully implementing recoverable depreciation on financial statements requires careful planning and monitoring. Companies should track all types of assets, both tangible and intangible, to accurately calculate their depreciated value over time.

In addition, it is essential to keep up with maintenance costs and repairs, as these can affect the amount of depreciation that needs to be accounted for. Finally, companies should also take full advantage of tax deductions when calculating their net income from recoverable depreciation.

By following these tips and tracking expenses carefully, businesses can get the most out of their assets while maintaining accurate financial records.

Potential Challenges with Implementing Recoverable Depreciation:

Although recoverable depreciation can be beneficial for businesses, there are potential challenges that must be taken into account.

- Calculating recoverable depreciation can be complex and time-consuming, involving many variables such as the age of the asset, its market value, and repair costs.

- When filing taxes, companies must ensure they are taking full advantage of available tax deductions. This can involve significant paperwork and planning to maximize their financial benefit.

- If a business does not correctly track its assets over time, it could result in inaccurate calculations or poor management decisions, negatively affecting performance.

For these reasons, businesses must consider all potential risks and rewards when implementing recoverable depreciation.

Conclusion:

Recoverable depreciation can provide several financial benefits for businesses, including income tax deductions and increased profits. However, if not managed correctly, it can significantly impact the long-term performance of the business. Companies should track their assets closely and make necessary adjustments to minimize their effects. Doing so allows them to take full advantage of available tax deductions while managing their finances effectively. In conclusion, recovery depreciation can be an effective tool for increasing profitability but must be handled carefully to maximize its benefits.

FAQs:

Q: What is recovery depreciation?

A: Recovery depreciation is the process of accounting for the decrease in value of an asset over time, usually due to wear and tear or obsolescence—tangible and intangible assets such as buildings, vehicles, or software.

Q: What are some tips for successfully implementing recoverable depreciation on financial statements?

A: Some tips for successfully implementing recoverable depreciation include tracking all types of assets, keeping up with maintenance costs and repairs, taking full advantage of available tax deductions, and monitoring expenses closely.

Q: Are there any potential challenges with implementing recoverable depreciation?

A: Yes, there are potential challenges with implementing recoverable depreciation, such as complex calculations, paperwork for filing taxes, and inaccurate tracking of assets. Companies need to consider all possible risks and rewards before implementing recoverable depreciation.

REITs vs Real Estate Investment Funds: How They Compare

Best Boat Loans

Criteria for Achieving Public Limited Company Status

How Is Margin Interest Calculated?

4 Ways to Remove Your Name Off a Cosigned Loan

Twitter Feeds Investors Should Follow

Best Student Loans for Bad Credit