Best Boat Loans

Oct 28, 2024 By Kelly Walker

Are you ready to join the ranks of proud boat owners? Whether you're an experienced seafarer or a first-time buyer, taking out a loan for your new vessel can be an intimidating experience. But take heart - with the right lender, getting funding for your dream boat doesn't have to feel overwhelming.

With Best Boat Loans on your side, you'll get all the info and assistance needed to secure a loan with excellent rates and terms. Learn why our customers love us today.

Boat Loans

Boat loans are a type of loan that can be used to purchase boats and other marine vessels. Like traditional auto loans, boat loans usually have fixed interest rates and terms you agree upon with your lender. Boat loans are secured against the boat itself and require collateral as a down payment or equity in the vessel.

The size of a loan will depend on factors such as credit score, income level, the cost of your boat, and more. Best Boat Loans specializes in helping buyers secure these loans quickly and easily so you can get out on the water in no time!

Why Choose Better Boat Loans?

At Best Boat Loans, we understand that taking out a loan for an expensive item, such as a boat, can be intimidating. That's why we strive to make the process as simple as possible. Our experienced loan specialists are here to answer any questions and provide helpful guidance.

We also offer competitive interest rates, flexible terms, and various loan options to choose from so you can find the right fit for your budget. Our application process is fast and easy so that you can get approval quickly.

Different Types of Boat Loans

At Best Boat Loans, we offer several different types of boat financing to meet your needs.

- Boatinancing: If you already have a boat, you can refinance your existing loan on better terms and save money in the long run.

- Marine Loans: Marine loans are specifically designed to finance new or used boats, personal watercraft, and marine vessels of any size.

- Boat Equity Loans: Equity loans are secured by the equity in your boat and can help you get cash quickly without taking out a large loan.

- Personal Loans: Personal loans provide flexible financing options with no collateral required, allowing you to borrow up to $50,000 for any purpose at competitive rates.

At Best Boat Loans, we strive to make the boat-buying process as easy and stress-free as possible. We offer flexible financing solutions with competitive rates and terms so you can get the loan you need to make your dreams come true. Contact us today to learn more about our services, or apply online now.

Benefits of Working With Best Boat Loans

- Competitive interest rates and flexible terms

- Experienced loan specialists answer questions

- Variety of loan options to choose from

- The fast and easy application process

- No collateral is required for some loans

- Low down payments or no down payment options available

- Financing for new and used boats, personal watercraft, and other marine vessels

- Loan refinancing options to save money in the long run

- Dedicated customer service team to help you through every step of the process

- Comprehensive insurance coverage to ensure your boat is well protected.

At Best Boat Loans, we're dedicated to helping our customers get out on the water with peace of mind knowing that their financing is secure and affordable.

Drawbacks of Working With Best Boat Loans

Working with Best Boat Loans is fine.

- Financing is unavailable for marine vehicles, such as jet skis or sailboats.

- Boat loans are secured by the boat and require collateral as a down payment or equity in the vessel.

- Some loan options may require a certain credit score or income level to qualify for financing.

- Depending on your financial situation and credit history, there may be limitations on the amount you can finance.

- Interest rates may vary based on credit score, income level, etc.

- Federal laws regarding boat loans may affect loan terms and conditions depending on where you live and what boat you purchase.

At Best Boat Loans, we strive to provide our customers with the best financing options.

Costs of Owning a Boat

Owning a boat is an exciting and rewarding experience but comes with certain costs. Before you decide to purchase a boat, it’s important to understand all the associated expenses.

Some of the most common costs of owning a boat include:

- Purchase Price - The cost of buying a new or used boat can vary greatly depending on size, type, and condition. Used boats may offer more cost-saving options than brand-new ones.

- Registration Fees - Most states require registration fees for any watercraft owned in their jurisdiction, including boats, jet skis, and other types of marine vessels. Depending on where you live and what type of vessel you own, these fees may range from $25 to over $500.

- Insurance - Boat ownership requires liability insurance in case of an accident or injury. Different types of boats may require different levels of coverage, and the cost for this can vary significantly depending on your provider.

- Maintenance/Repairs - Maintaining a boat’s condition is important for safety and retaining its value. Regular service and repairs can be costly depending on the type and age of your boat.

- Fuel Costs - Fuel costs are an ongoing expense when owning a boat. Boats use more fuel than cars and trucks, so these costs can add up quickly if you plan on taking extended trips or touring often.

- Storage Fees - If you plan on using your boat mainly in the summer, you’ll need to factor in storage fees for the winter months. This can range from $300 - $1,000 or more, depending on where and how you store your vessel.

These are just some of the costs associated with owning a boat. It’s important to consider all of these factors before making any decisions. When you work with Best Boat Loans, we can help guide you through the entire process and provide competitive financing options with great rates and terms so you can get out on the water without breaking the bank.

FAQS

What is the best interest rate for a boat loan?

The best interest rate for a boat loan depends on your credit score and financial situation. Generally, borrowers with higher credit scores get better interest rates than those with lower ones.

How long is the term of a boat loan?

The term of a boat loan can vary from 12-30 years, depending on the lender and the type of boat you are purchasing.

Do I need collateral to get a boat loan?

Yes, most boat loans require collateral such as a down or equity in the vessel. It will help secure the loan and ensure the lender can recoup their funds if you default on your payments.

Conclusion

After researching the many different options for boat loans, it's clear that Best Boat Loans is the most reliable and cost-effective option. With their low rates, flexible payment plans, and fast loan processing times, Best Boat Loans provides an ideal solution for anyone looking for a reliable way to finance their new boat or yacht. They also have excellent customer support if you have any questions during the financing process.

Staying Ahead: Aligning with Current Investment Waves and Trends

What are Top Personal Loans for Excellent Credit

How Is Margin Interest Calculated?

Best Biotech ETFs

Form W-4: Employee's Withholding Certificate

Criteria for Achieving Public Limited Company Status

The Top 10 Features of the Best Budgeting Software on the Market

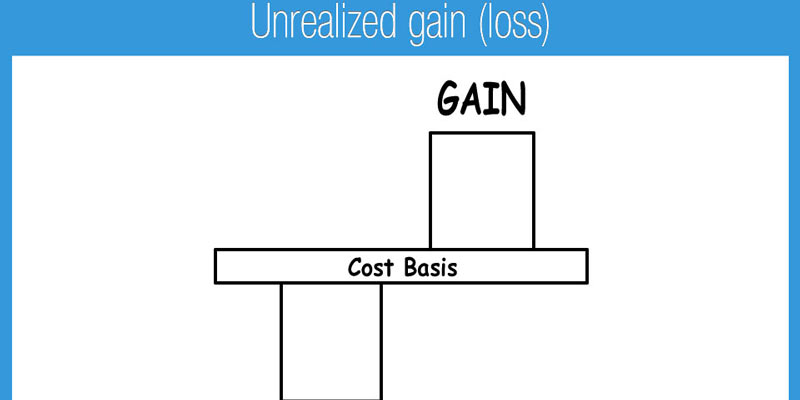

What Are Unrealized Gains and Losses?

PNC points Visa Credit Card Review