What Are Unrealized Gains and Losses?

Jan 15, 2025 By Rick Novak

Do you own some stocks in your portfolio? If so, the unrealized gains and losses may sound familiar to you. Unrealized gains and losses are a way for financial planners and investors to analyze the current performance of their assets — more specifically, their equity investments. This may be an intimidating phrase to wrap your head around if finance does not come easily or naturally to you, so let's break it down!

In this blog post, we'll explain exactly what unrealized gains and losses are, why they matter for investors and traders alike, how they affect tax liabilities at the end of the year, as well as look into some real-world examples of why understanding these concepts can make all the difference. So keep reading to learn more about this essential part of investing today!

Dealing With Unrealized Gains

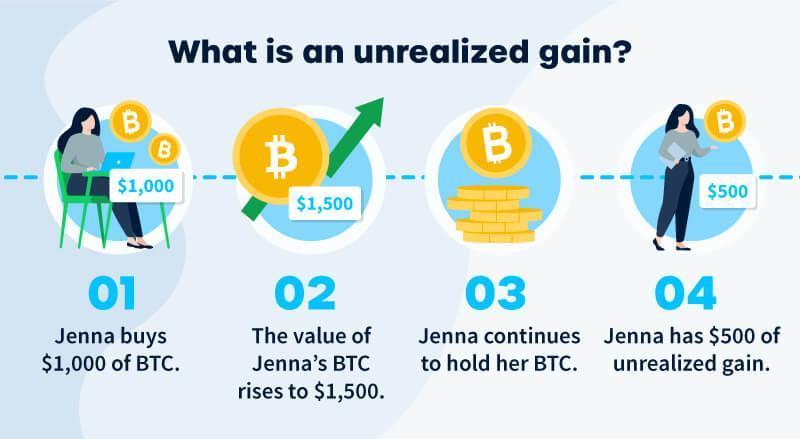

Unrealized gains and losses are important for investors to understand when managing their portfolios. Put unrealized gains or losses represent the potential growth or decline in value of investments that haven't been realized by selling them. This means that any profits or losses have yet to be realized and are only potential gains or losses.

Unrealized gains can be positive or negative depending on whether the stock trades at a higher value than when it was bought. To realize the gain, investors must sell their holdings at a higher price than they paid for them initially. Until this occurs, these gains remain unrealized.

Tax implications are another important consideration when dealing with unrealized gains and losses. In the US, if a stock is held for more than one year before being sold by an investor, then any realized gains from the sale are subject to capital gains tax. On the other hand, investors may defer taxes on their unrealized gains but must keep track of them.

It's important to note that unrealized gains and losses are not set in stone — market forces can cause the value of investments to fluctuate, leading to potential changes in the value of your portfolio holdings. As such, investors should monitor their portfolios regularly and be vigilant about reviewing the performance of their investments.

Overall, dealing with unrealized gains and losses can be a complex process, but understanding how they work is essential for any investor looking to maximize success in the market. Keeping track of these potential gains or losses is important to make informed investment decisions that are right for you and your financial objectives.

Handling Unrealized Losses

Unrealized losses are an important concept to be aware of when managing a portfolio. They refer to the potential decline in the value of investments that have yet to be realized through selling them. This means that any losses haven't been incurred yet, but remain a possibility until the stocks are sold.

Investors need to understand the implications of holding on to stocks to avoid realizing losses. The longer a stock is held, the greater the potential for its value to decline, potentially leading to realized losses. As such, investors must monitor their portfolios regularly and be aware of any market conditions or stock performance changes that could lead to unrealized losses.

Tax implications also come into play when dealing with unrealized losses. In the US, realized losses incurred by selling stocks held for more than one year can be used to offset capital gains taxes on realized profits in other investments. This helps investors to minimize their future tax burden, although it should be noted that any unused losses can only be carried forward to the following tax year.

Dealing with unrealized losses is an important part of managing a successful portfolio, and understanding how they work is essential for any investor looking to maximize returns in the market. Keeping track of potential losses is key to identifying trends and making informed decisions that are right for you and your financial objectives. Investors can avoid realizing significant portfolio losses by properly monitoring and managing unrealized losses.

Assessing Tax Consequences

Tax consequences are an important consideration when dealing with unrealized gains and losses. In the US, capital gains taxes apply to any realized gains resulting from selling stocks held for one year or more, while losses incurred in this manner can be used to offset taxes on other realized investments.

It's important to note that unrealized gains and losses are not set in stone — market forces can cause their value to fluctuate, leading to potential changes in the tax implications of an investor's portfolio holdings. As such, investors should monitor their portfolios regularly and be aware of any changes that could affect their taxes.

For instance, if an investor holds a stock for more than one year and determines that its unrealized gains have increased significantly, they may choose to sell the stock before realizing the gains to avoid paying capital gains taxes. However, this could also lead to potential losses if market conditions change unexpectedly, so investors must assess their tax situation carefully before making any decisions regarding their investments.

It's also important to note that any unused losses can be carried forward to future tax years to offset capital gains taxes, so investors should consider this when determining their tax strategy.

Assessing the tax consequences of unrealized gains and losses is a key part of successful portfolio management. By understanding the tax implications of their investments, investors can identify potential opportunities to minimize the taxes they'll owe on realized gains and losses. With the right strategy, investors can ensure their portfolios are managed for maximum returns and efficiency.

How Capital Gains Are Taxed

In the US, capital gains taxes apply to any realized profits from selling stocks held for one year or more. This means that investors must pay tax on any profits earned from their investments — even if those profits have only been unrealized until the sale.

Short-term capital gains (gains generated from selling stocks held for one year or less) are subject to normal income tax rates, while long-term capital gains (gains generated from selling stocks held for more than one year) are typically taxed at a lower rate.

Examples of Unrealized Gains and Losses

Let's say an investor buys 100 shares of XYZ stock for $50 per share. Over one year, XYZ's price increased to $70 per share, and the investor has realized an unrealized gain of $2,000 ($20 x 100 shares).

If they decide to sell their shares at this point, they will have to pay capital gains taxes on the realized gain. However, if the stock drops in value before they decide to sell, its unrealized loss can offset the tax liability for any other realized investments.

FAQs

Where do unrealized gains and losses go?

Realized gains and losses are only realized once the assets are sold. At this point, any capital gains taxes will be due on the profits generated from selling stocks held for more than one year. Alternatively, unrealized losses can offset the tax liability for other realized investments.

Any unused losses can be carried forward to future tax years to minimize the taxes owed on realized gains and losses. Understanding the implications of unrealized gains and losses is essential when taking advantage of potential savings opportunities while minimizing tax liabilities.

Is unrealized gain debit or credit?

Unrealized gains are not reflected in the accounting books, as they have not been realized through a sale and thus cannot be debited or credited. Instead, unrealized gains (or losses) are tracked by investors and traders to measure the performance of their investments over time.

Can I claim unrealized gains or losses?

No, you cannot claim unrealized gains or losses on your taxes. Unrealized gains and losses are only applicable to assets that have been sold — meaning that the profits or losses must be realized for them to be taxed. In other words, you can only pay capital gains taxes on any profits generated when selling stocks held for more than one year.

Conclusion

Overall, while unrealized gains and losses cannot be debited or credited, they are important for investors and traders to understand to manage their portfolios and minimize their tax liabilities. By understanding the implications of these gains and losses, investors can work towards optimizing their returns and minimizing taxes owed on realized profits. Additionally, any unused losses can be carried forward to future years to further reduce the burden of taxes owed on realized gains and losses.

How Is Margin Interest Calculated?

PNC points Visa Credit Card Review

How Do You Transfer Common Stock From One Broker to Another

4 Ways to Remove Your Name Off a Cosigned Loan

The Top 10 Features of the Best Budgeting Software on the Market

Best Boat Loans

How to Buy a Home With Good Resale Value

Avant Personal Loans Review

What Is Form 1095-C: Employer-Provided Health Insurance Offer and Coverage?