What are Top Personal Loans for Excellent Credit

Dec 24, 2024 By Kelly Walker

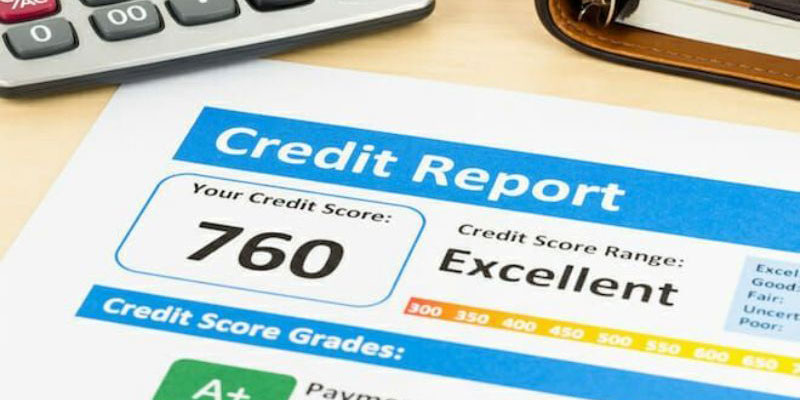

If you have an excellent credit score, you can get approved for the best personal loan options available in the market. Lenders view borrowers with high credit scores as less risky, making qualifying for lower interest rates and better loan terms easier.

Best Loans for Excellent Credit

Here is the list of some Best Loans for Excellent Credit:

LightStream Personal Loans

LightStream is a top lender offering personal loans for excellent credit borrowers. The lender is known for its competitive interest rates, flexible loan terms, and no-fee policy. LightStream offers loans ranging from $5,000 to $100,000, with 24 to 144 months’ repayment terms. LightStream is a division of SunTrust Bank and operates entirely online, making it an ideal choice for borrowers who prefer to apply for and manage their loans online.

One of the standout features of LightStream personal loans is the company's Rate Beat program. If you find a lower interest rate from another lender, LightStream will offer a rate that's 0.10% lower than the competitor's rate. LightStream also has a quick and easy online application process, and borrowers can receive their funds as soon as the same day they apply.

SoFi Personal Loans

SoFi is a popular lender that offers personal loans to borrowers with excellent credit scores. The company offers loans ranging from $5,000 to $100,000, with 24 to 84 months’ repayment terms. SoFi is an online lender that prides itself on its low rates and flexible loan terms. SoFi also offers borrowers the option to defer payments for up to three months in case of economic hardship. SoFi's application process is entirely online, and borrowers can receive their funds within a few days of approval.

Discover Personal Loans

Discover is a well-known lender that offers personal loans for excellent credit borrowers. Discover's personal loans range from $2,500 to $35,000, with 36 to 84 months' repayment terms. Discover is unique in that it allows borrowers to apply for a joint loan, which can be helpful for couples or family members who want to consolidate debt or make a large purchase together.

Discover personal loans have fixed interest rates, so borrowers can expect predictable monthly payments. Additionally, Discover offers borrowers the option to defer payments for up to two months, making it an ideal choice for borrowers who may experience financial hardship.

Marcus by Goldman Sachs Personal Loans

Marcus by Goldman Sachs is another top lender offering personal loans for excellent credit borrowers. The company offers loans ranging from $3,500 to $40,000, with 36 to 72 months’ repayment terms. Marcus is known for its competitive interest rates, with rates as low as 6.99% APR for borrowers with excellent credit.

Additionally, borrowers can receive a 0.25% interest rate discount if they enroll in autopay. Marcus also offers borrowers the option to defer payments for one month after making 12 consecutive on-time payments.

Earnest Personal Loans

Earnest is a lender offering personal loans to borrowers with excellent credit scores. The company offers loans ranging from $1,000 to $100,000, with 12 to 84 months’ repayment terms. Earnest is known for its flexible loan terms, which allow borrowers to customize their monthly payment amount and payment date.

Additionally, borrowers can receive a 0.25% interest rate discount if they enroll in autopay. Earnest is also unique in that it considers more than just credit scores when evaluating loan applications. The company determines a borrower's creditworthiness by looking at factors like savings habits, education, and employment history.

Citizens Bank Personal Loans

Citizens Bank is a well-known lender that offers personal loans for excellent credit borrowers. The bank offers loans ranging from $5,000 to $50,000, with repayment terms of 36 to 84 months’ repayment terms. Citizens Bank is unique because it offers borrowers the option to choose between a fixed or variable interest rate.

Citizens Bank personal loans have no application fees, origination fees, or prepayment penalties. Additionally, borrowers can receive a 0.25% interest rate discount if they enroll in autopay. Citizens Bank also offers a unique benefit for borrowers with a Citizens Bank account. These borrowers can receive an additional 0.25% interest rate discount on their personal loans.

Payoff Personal Loans

The Payoff is a lender specializing in personal loans for borrowers with excellent credit scores. The company offers loans ranging from $5,000 to $40,000, with 24 to 60 months’ repayment terms. The payoff is unique in that it focuses on helping borrowers consolidate credit card debt and improve their financial wellness. Payoff also offers borrowers access to a free monthly FICO score update, allowing them to monitor their credit scores and track their progress toward financial goals.

Rocket Loans Personal Loans

Rocket Loans offers personal loans to borrowers with excellent credit scores. The company provides loans ranging from $2,000 to $45,000, with 36 or 60 months’ repayment terms. Rocket Loans is unique in providing a quick and easy online application process, allowing borrowers to receive loan offers within minutes of applying.

Rocket Loans personal loans come with zero prepayment penalties or origination fees. Additionally, borrowers can receive a 0.30% interest rate discount if they enroll in autopay. Rocket Loans also offers a unique benefit for borrowers who hold a Rocket Mortgage or Quicken Loans account. These borrowers can receive an additional 0.30% interest rate discount on their personal loans.

TD Bank Personal Loans

TD Bank is a well-known lender offering personal loans to borrowers with excellent credit scores. The bank offers loans ranging from $2,000 to $50,000, with 12 to 60 months’ repayment terms. TD Bank is unique because it offers borrowers the option to choose between a fixed or variable interest rate.

There are no origination fees or prepayment penalties, and borrowers can receive a 0.25% interest rate discount if they enroll in autopay. TD Bank also offers borrowers the option to add a co-signer to their loan, increasing their chances of approval or helping them qualify for a lower interest rate.

Conclusion

An individual with excellent credit has access to some of the best personal loans on the market. The lenders mentioned in this article offer competitive interest rates and flexible repayment terms, making them excellent options for borrowers looking to finance various expenses. Before applying for a personal loan, compare loan offers from multiple lenders to ensure you get the best deal possible.

Form 9465: Installment Agreement Request

What Are Unrealized Gains and Losses?

What Is a Float-Down Lock in Mortgage Rates?

What Is Form 1095-C: Employer-Provided Health Insurance Offer and Coverage?

The Top 10 Features of the Best Budgeting Software on the Market

Impact of Recoverable Depreciation on Financial Statements

Best Student Loans for Bad Credit

What are Top Personal Loans for Excellent Credit

Best Biotech ETFs