Staying Ahead: Aligning with Current Investment Waves and Trends

Oct 05, 2024 By Kelly Walker

Investment trends change and grow as the global economy and technology progress. This could be your cue to investigate what's now in vogue as an investing opportunity.

Socially and Responsible conscious investment (SRI)

The concept of sustainability has evolved into a social movement in its own right. Companies are paying attention to consumers' growing awareness of their environmental impact and their growing worry over climate change. Sustainable and responsible investing (SRI) has emerged in response to this transition, with its focus on identifying and supporting businesses with strong environmental, social, and governance (ESG) practices.

Key Takeaways

- Many large financial institutions now take ESG considerations into account.

- Long-term financial results tend to be better for companies that prioritize ESG.

- Investment is rising in environmentally friendly industries like renewable energy, organic farming, and green technology.

Inflation Protection

With inflation expected to reach multi-decade highs in 2023 it has highly impacted the investing trends safeguarding your savings has never been more important. The inflation risk is mitigated by purchasing Series I Bonds or Treasury Inflation-Protected Securities (TIPS).

Key Takeaways:

- The purchasing power of your money is safeguarded by inflation-adjusted rates on TIPS and I Bonds.

- In the long run, stocks can be a good way to protect yourself from inflation if you invest in those companies that have great pricing power.

- Gold is a popular inflation hedge and can be bought directly or through exchange-traded funds like SPDR Gold Shares (GLD).

P2P (Peer to Peer) Lending

Peer-to-peer (P2P) lending systems link borrowers directly with individual lenders. The interest rates offered by these sites are often higher than those offered by banks to savers.

Key Takeaways:

- P2P lending has gained popularity because of websites like Lending Club and Prosper.

- The risk can be reduced by spreading it across several loans.

- The terms of the platform and the risk of default must be thoroughly understood.

Ethical, Social, and Governance Investments

The worldwide pandemic has increased the spotlight on businesses with strong ESG (environmental, social, and governance) policies. Sustainable company practices are being seen as more valuable by investors than quick profits.

Key Takeaways:

- Companies with a strong emphasis on ESG tend to be more stable and exhibit less volatility.

- Companies with strong ESG policies have greater three-year returns and lower bankruptcy rates, according to research conducted by Bank of America.

- Mutual funds and exchange-traded funds (ETFs) like the iShares MSCI USA ESG Select ETF (SUSA) make investing in ethical businesses simple.

Crowdfunding for Real Estate

Investing in real estate has a long history of success. However, typical investors were often put off by the high barrier to entrance. Crowdfunding websites for real estate have leveled the playing field by making it possible for individuals to invest in real estate with a lesser outlay of capital.

Key Takeaways:

- Real estate investment has become more accessible because of online platforms such as Fundrise and RealtyMogul.

- Investors no longer require a sizable starting capital to diversify their portfolios with real estate.

- As with any investment, you need to do your research.

Income Investing

The allure of income investment has returned as interest rates have increased. After years of near-zero interest rates, high-yield savings accounts and Certificates of Deposit (CDs) are finally delivering returns above 5 percent.

Key Takeaways:

- High-dividend stocks and dividend funds provide investors with the opportunity to earn a steady income while also growing their wealth.

- The Vanguard High Dividend Yield Exchange Traded Fund (VYM) and the Schwab US Equity Dividend Exchange Traded Fund (SCHD) are two such funds.

- Investment income can act as a safety net during times of high inflation or serve as a complement to your main source of support.

FAQs

What makes SRI (Socially Responsible Investment) so appealing?

More and more people are seeing the long-term advantages of investing in businesses that care about the environment, their employees, and their community, which has led to a rise in the popularity of Sustainable and Responsible Investing (SRI). These businesses tend to be more robust, exhibit less volatility, and produce superior long-term results. Moreover, SRI enables investors to back companies that make beneficial contributions to society and the environment in line with their own principles.

How can I protect my investments from inflation?

Investments can be shielded from inflation in a number of ways. Your purchasing power will be protected from inflation with a Treasury Inflation-Protected Security (TIPS) or Series I Bond. In addition, stocks can be a useful long-term inflation hedge, especially those of companies with considerable pricing power. Gold is a safe haven for certain investors during times of high inflation. In order to successfully navigate inflationary settings, it is crucial to diversify one's investment portfolio and to consider consulting with financial professionals.

How does buying high-dividend companies or dividend-paying mutual funds help one's financial situation?

Income investors often choose to put their money into stocks with high dividend payouts or dividend ETFs. In the form of dividends, these investments distribute a percentage of the company's profits to their owners on a regular basis. These payments are made on a quarterly basis, albeit this is not always the case.

What Is a Covenant-Lite Loan?

What Is a Float-Down Lock in Mortgage Rates?

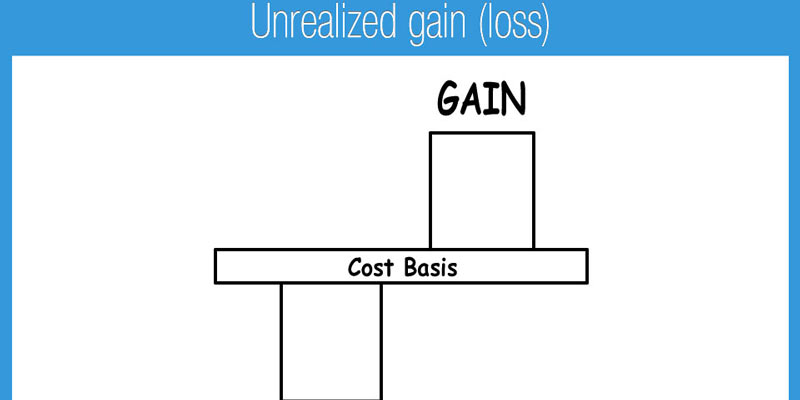

What Are Unrealized Gains and Losses?

What Is Form 1095-C: Employer-Provided Health Insurance Offer and Coverage?

How Is Margin Interest Calculated?

Best Debt Relief Companies

What are Top Personal Loans for Excellent Credit

Zero Interest Loans: Why You Should Beware

Why Not Buy Before the Dividend and Then Sell?