Best Credit Monitoring Services

Oct 15, 2024 By Kelly Walker

Credit Monitoring services are those services that keep a watch on a customer’s credit report and warn them of any upcoming potential issues. Many people who subscribe to these services get notifications for any doubtful and suspicious activities. Significant fluctuations in a person’s bank balance or opening a new account under someone else’s name are examples of fraud.

The Best Credit Monitoring Services offered are:

- Credit Sesame

- Credit Karma

- Experian

- Experian IdentityWorksSM

- Identity Guard,

- IdentityForce

- IdentityIQ

- PrivacyGuard

Among these, the first three are the best non-paid credit monitoring services.

As you read, you will learn about the credit monitoring services offered by various companies and why they are best in this domain.

Best free credit monitoring services

Free services tend to come with lesser advantages than paid alternatives. These are a good option for those who want to regularly monitor their credit score instead of entirely relying upon websites and apps that provide you with a fraud warning and monthly credit score updates.

Credit Sesame

Credit Sesame is a credit monitoring company led by various venture capitalists, engineers, and finance professionals. The main aim behind establishing this firm was to assist people in improving their credit scores and creating economic stability. It does not require you to enter any personal credit card details.

You must create an account to start availing of its credit monitoring feature. As a member of credit sesame, you get a $1 million complimentary fraud insurance, daily credit monitoring alerts, and live identity restoration help. Although it is a free service, it does not monitor your social security number and only shows credit reports from the TransUnion credit bureau.

Credit Karma

This free monitoring service gives users genuine credit reports and weekly score updates. These weekly scores are updated based on the data from TransUnion and Equifax credit bureaus. You can track your scores through their mobile application or company webpage. The easy accessibility of this credit monitoring company allows people to apply the valuable insights it provides to improve their credit scores. However, the company does not offer insurance for identity theft. It also leaves out the credit report data from the third credit bureau, Experian.

Experian

As mentioned above, Experian is one of the three credit bureaus that monitor your credit report. As a subscriber of this company, you receive warnings for changes in account balances, new credit requests and inquiries, and any unusual activity.

In every 30 days, it will notify you of any visible increase or decrease in your credit utilization. The drawback of this is that it uses only Experian’s credit data. However, it includes access to FICO score data.

Top Paid Credit Monitoring Services:

1. Experian IdentityWorksSM

Experian IdentityWorksSM is the best overall credit monitoring service with a 30-day trial option. People can subscribe to different plans according to their needs, making it a flexible option for individuals and families.

If you need access to reports from all three bureaus, you must unlock the option by paying a slightly higher price than the entry-level package. Both premium and entry-level plans provide the same services. The only difference is that only Experian data is used for the basic plan, and all three credit bureau data are used for the premium version.

The cons include the unavailability of 24/7 customer assistance and computer security tools.

2. Identity Guard

Introduced by the digital security provider Aura, Identity Guard is one of the best credit monitoring companies. Its services come in three plans: individual, family, and ultra plans. All these plans include a 1 million dollar insurance from identity theft.

Ultra plan being a strong service offered, includes facilities like credit and debit card monitoring, credit report from all three bureaus, and tracking of other investments. It provides a user-friendly interface on its websites and mobile apps and is a committed US-based credit case manager.

The disadvantage is that credit monitoring is unavailable in the basic plan packages, family plans get more expensive for a larger family, and special features come only with the Ultra plan.

3. IdentityForce

IdentityForce is the best choice for three-bureau credit monitoring. Developed by TransUnion, it is preferred by most people who want comprehensive features. All available plans provide up to $1 million in insurance against identity theft.

They do not disclose information about their family plans on their websites. However, you may contact IdentityForce personally for pricing and package details. The only drawback it comes with is that the entry-level plans are more expensive than its market competitors.

4. IdentityIQ

IdentityIQ has three plans, Secure Pro and Secure Max, which offer its subscribers a three-bureau credit monitoring, while Secure Max offers credit score tracking and simulation. This service provider is famous for including family protection plans without asking for any additional charges. If you are comfortable with only one credit bureau monitoring, you can opt for the basic plans available at lower prices.

5. Privacy Guards

With a 24/7 credit monitoring service and a 14-day trial available at only $1, Privacy Guard includes social security monitoring, dark web scanning, debit and credit card monitoring, and other credit monitoring facilities.

However, the credit score reports provided by PrivacyGuard are of CreditXpert and are not used for making lending decisions like FICO Scores. It does not offer separate plans for families, and the credit plan does not include identity theft insurance.

FAQs

How to choose a credit monitoring service

Choosing the right credit monitoring service requires first understanding your needs and then subscribing to your affordability. Many top credit monitoring companies offer their potential customers a free trial period. With the help of this, you may judge and select the option that suits you.

What is the most accurate credit checker?

The most accurate credit checker will be the website that lets you access the credit score report from all three credit bureaus - Experian, TransUnion, and Equifax as a free service.

- What are the three credit monitoring bureaus?

Credit monitoring bureaus keep track of your credit score by keeping a watch on your financial activities. The three major credit bureaus, TransUnion, Experian, and Equifax perform this task. Results from all three vary slightly, but the type of information collected by all three for the process is similar.

- What is a credit monitoring tool?

Credit monitoring tools protect you against any identity theft, warn you about suspicious activities in your account, and help maintain a healthy credit score.

Conclusion

All the above-mentioned top credit monitoring companies offer the best credit monitoring services. Every company stands out from its competitors for the best features they have. There are separate plans for individuals and families according to their needs. Therefore, you must carefully read the pros and cons before subscribing to such services.

Starbucks Rewards Visa Review 2023

Original Issue Discount (OID): What is it?

How To Figure Out The Deductible For Hurricane Insurance

How To Cancel a Credit Card the Smart Way

What Are the Objectives of Financial Accounting?

Why You Should Grab a Gas Credit Card Today!

What Is Bank Credit?

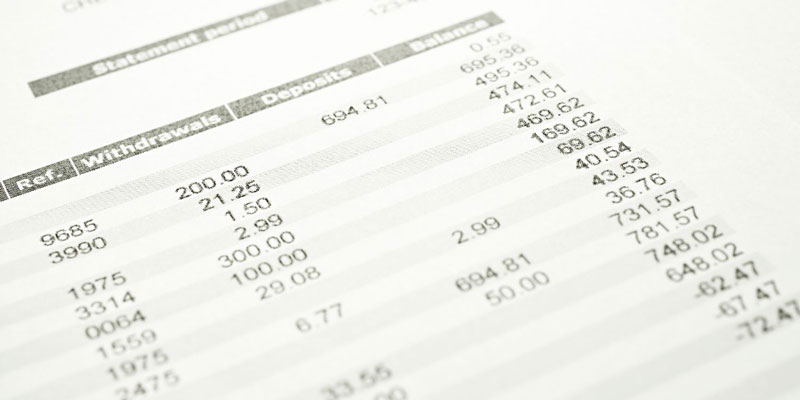

Things You Need to Know About an Account Statement

HSBC Premier World Mastercard Credit Card Review