How to Deal With Huge Trading Losses

Oct 26, 2024 By Marie White

Have you ever experienced having a huge trading loss and not knowing how to deal with it? It's a difficult situation, but there is hope.

Knowing how to effectively handle big losses can be an invaluable skill for any trader, and in this article, we will look into exactly what steps should be taken when confronting such challenges.

We'll discuss why it's important to stay composed after such losses and explore strategies that will help traders make well-informed decisions in the future so that they may improve their skills and performance over time.

So if you're looking for guidance on the best to handle big trading losses, keep reading!

Acknowledge the Loss – Accept that mistakes were made and avoid making excuses or blaming others.

Instead of worrying about who was responsible, focus on analyzing what went wrong so that you can make well-informed decisions in the future.

Reflect on what could have been done differently, change your strategy, and commit to learning from the experience. This will help ensure similar losses are avoided in future trades.

Finally, stay composed after such a loss - do not let emotions dictate your next move, as this could lead to more poor decisions. Taking the right steps can teach you to handle huge trading losses and be better prepared for success in your next trade.

What Went Wrong – Review your decisions, strategies, and tactics to identify what may have gone wrong.

When dealing with a huge trading loss, traders need to take the time to analyze what went wrong. This means reviewing their decisions, strategies, and tactics to identify areas that may have caused the losses.

It's important to stay composed during this process and avoid making rash decisions that could further compound the losses. Taking a step back and objectively reviewing your trading activity can help you learn from your mistakes and become a better trader in the future.

To start, look at the types of trades you were taking and ask yourself if they were risky or if any underlying issues could have contributed to the loss.

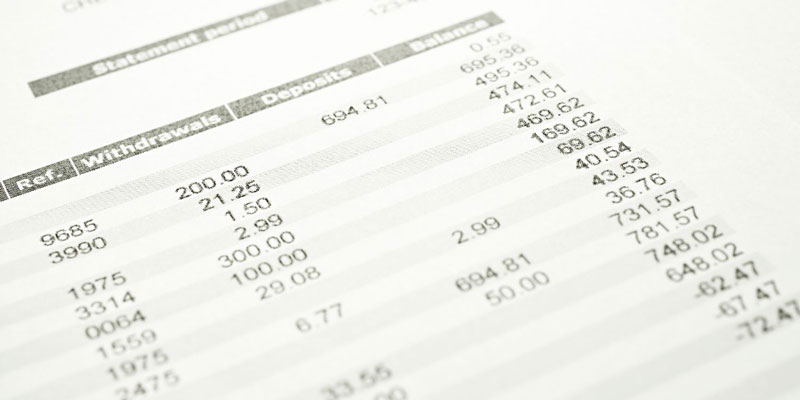

Also, consider whether your timing was off – did you enter too early or too late? To better understand the problem, document your trades and review them closely. You can then use this information to change your trading approach to avoid making similar mistakes in the future.

Finally, be sure to track your performance over time to see if there is any improvement or if further adjustments need to be made. The more effort put into analyzing previous losses and adapting accordingly, the better the chance traders have of mitigating risks and being profitable long-term.

Analyze and Make Changes to Your Strategy – Adjust your trading style to be more conservative or aggressive, depending on the situation.

When dealing with a huge trading loss, it is important to analyze the mistake and adjust your trading strategy. Doing this will help you prevent similar losses from happening in the future.

Take time to understand what went wrong and consider how you can alter your approach going forward.

Depending on the situation, you may choose to be more conservative or aggressive, but always be sure that you are sticking with a strategy that has proven successful before. Try different strategies to see what works best for you - remember to factor in risk management when choosing an approach.

Finally, document your findings so that you can refer back to them and ensure consistent results over time. With dedication and practice, traders can learn how to manage their risks, successes, and losses effectively.

Learn From Your Mistakes – Identify areas of improvement and use them as a learning opportunity for future trades.

When traders suffer a large trading loss, it is important to stay composed and identify areas of improvement. Doing so can help turn it into an invaluable learning opportunity for future trades and improve overall performance.

One of the best ways to use this experience as a teaching tool is to conduct an in-depth analysis of all aspects that may have contributed to the loss.

This includes looking at risk management protocols, analyzing past decisions, and considering market conditions or sentiment changes that could have been overlooked.

Another useful step is to develop strategies for dealing with similar situations in the future. This might include setting protective stop losses closer to entry points, diversifying one’s portfolio, or hedging investments with other assets.

Finally, a trader should take the time to reflect on how he or she reacted to the loss. Was the right strategy employed? Were there any emotional responses that could have been avoided? The answers can then be applied when forming trading plans for future investments.

Have Patience With Yourself – Remember that mistakes are part of the process; take a break if necessary, and focus on the positive aspects of trading.

It’s natural to feel frustrated and discouraged after a huge trading loss. But it is important to remember that these setbacks aren't the end of the world and are essential to learning how to trade successfully.

Taking a step back and reminding yourself that mistakes are part of the journey will help you keep your head in the right place.

It can also be beneficial to take a break from trading if needed, as this will give you time to process your emotions while allowing your mind to recharge. In addition, try focusing on all the positive aspects of trading, such as having control over what you do with your money, diversifying investments, making decisions based on data-driven analysis, and so on.

Finally, remember to be patient with yourself and don't let one mistake define your trading journey.

With the right strategies in place, a huge trading loss can serve as an opportunity to learn how to make better decisions in the future. Keep your head up, stay composed, and strive for continued improvement!

Move On To The Next Trade – Don't dwell on past losses; look ahead to plan your next move.

Dealing with huge trading losses can be a difficult experience. It is important to remember that it is part of the process, and with proper planning, future trades can be successful. After suffering a big loss, take a step back and assess your current situation.

Reflect on what went wrong and determine what you could do differently the next time. By properly evaluating past mistakes, traders can make informed decisions in the future, avoiding similar circumstances.

FAQs

Why do 99% of traders lose money?

Most traders lose money because they need to have the proper training, knowledge, and experience. Furthermore, their trading strategies could be more effective and executed due to a lack of planning and an inability to adhere to rules.

What should I do after a big trading loss?

Staying composed after such losses and stepping back from the situation is important. Taking a break, seeking support from peers or mentors, or developing an action plan are all strategies that can help traders get through tough trading times.

How can I prevent big trading losses in the future?

To prevent big trading losses in the future, it’s important to do your research and develop a solid understanding of the markets. Additionally, traders should think about diversifying their portfolios to spread risk.

Conclusion

Every trader will experience losses at some point, and it's important to have the right mindset to confront these challenging situations. Acknowledge the loss, uncover what went wrong, analyze your strategy and make changes as needed, learn from your mistake, stay patient with yourself, and move on to the next trade. These tips can help you get back into trading – making informed decisions and managing your capital better.

Active vs. Passive Investing

Things You Need to Know About an Account Statement

Is Your State Tax Refund Taxable

Top 5 Airlines Offering Refundable Plane Tickets

How To Figure Out The Deductible For Hurricane Insurance

Lightspeed Review

Early Retirement: Strategies to Make Your Wealth Last

Child and Dependent Care Credit: Definition, Who Qualifies

Understanding Form 5498 and Its Importance for Taxpayers