Timing Your W-4 Withholding Adjustments: Best Practices

Aug 20, 2024 By Rick Novak

The pay-as-you-earn (PAYE) tax system requires most Americans to pay estimated income tax annually and account for it on tax day. Federal law requires employers to deduct a portion of employees' average salaries for taxes. Employers use Form W-4 information from new hires to calculate withholding. Employees receive rebates for over-withheld taxes.

What Are W-4 Withholdings?

Your paycheck is more than just a statement of your earnings; it reflects your tax planning strategy. The W 4 withholdings are the silent gears in the machinery of your financial life, quietly determining how much of your earnings you'll take home and how much goes to the IRS coffers.

Adjusting your W-4 withholdings is like fine-tuning an engine; it ensures you're not left with a surprise tax bill or a thinner wallet than necessary. It's about striking that perfect balance where you owe little at year's end nor overpay, only to receive a refund of your money months later.

Key Reasons to Adjust Your W-4 Withholdings

Several life events should prompt a review of your W-4 withholdings.

Changes in Marital Status

The IRS wants W-4 withholdings to indicate knot tying or untying. Marriage often unites hearts and wallets. An increase or decrease in your tax bracket might shift the game at tax time. Divorce can be a financial reset and an emotional rollercoaster—taxable income and tax bracket change when your tax status reverts.

Adjusting W-4 withholdings after a divorce is good practice and financial protection. It adjusts paycheck taxes to reflect your new marriage. The W-4 withholding calculator is your best friend for navigating your new life's figures.

Shifts in Household Size

The size of your household has a direct impact on your tax picture. A new baby brings joy and a different tax situation. Suddenly, you have another dependent, which can lower your tax liability. But it's not just about children; caring for an elderly parent can also shift your financial responsibilities and tax benefits.

Income Fluctuations

Income fluctuates. Getting a big raise, starting a side business, or losing your work might mess up your taxes. Your W-4 withholdings should be reviewed when your income and tax bracket change.

A new job or big raise is enough to celebrate but reevaluate your W-4 withholdings. The necessary W-4 withholding calculator lets you calculate the proper amount to withhold based on your new income.

Homeownership

Homeownership is a significant tax benefit. Mortgage interest deductions, property taxes, and energy credits affect tax obligations and W-4 withholdings.

In addition to housing, your home is a tax benefit. With the proper W4 withholding exemptions, you can balance your tax obligations with your lifestyle. It's about doing your homework for you, tax-wise.

Determining Your Withholding

Adjusting your W-4 withholdings is a proactive financial action, not just a form-filling exercise. Controlling your W-4 withholdings prevents you from being surprised by a large tax payment or overspending and providing the government with an interest-free loan.

1. Adjusting W-4 Withholdings

Start using the IRS's online Tax Withholding Estimator to calculate W-4 withholdings. It's designed to simplify federal income tax calculation. It estimates W-4 withholding based on several parameters.

Proactively using the W-4 withholding calculator prevents tax surprises. It's easy to match W-4 withholdings to your finances, sparing you from future issues. You can trust the calculator to calculate W-4 withholdings accurately by entering accurate information.

2. Updating Withholding with Employer

Take action if the W-4 withholding calculator shows a large tax payment gap. Tell your employer about changing your federal income tax withholding. Your employer may send a blank W-4 form or lead you to an online system to update your information.

Update your W-4 withholdings when needed for financial responsibility. It matches your withholdings to your tax responsibilities. Whether given a paper form or an electronic submission platform, manage W 4 withholding exemptions and changes quickly and accurately.

3. Accounting for Multiple Incomes

Step 2 on Form W 4 withholding exemptions is crucial for multi-job workers and couples. This step adjusts W-4 withholdings for combined income to ensure the proper amount is withheld.

W-4 withholdings might be complicated when many income streams are involved, but they're vital to avoid underpaying taxes all year. Step 2 must be completed correctly to manage W-4 withholding exemptions for multiple jobs or a dual-income family.

4. Incorporating Dependents

Step 3 of Form W-4 accounts for dependents' tax impact. Adjust your W-4 withholdings to reflect dependent tax reductions by completing this section.

This phase in revising W 4 withholding exemptions is about accurately representing your financial obligations, not just collecting benefits. This ensures that your W-4 withholding exemptions are correctly integrated into your paycheck to avoid overpaying taxes on dependents.

5. Reporting Additional Income

Consider interest, dividends, and retirement income when determining W-4 withholdings. Report these amounts on Form W-4, step 4(a).

These extra revenue streams should be included in W-4 withholding calculations for comprehensive tax planning. It adjusts your W-4 withholdings to cover taxes on all your income, not just wages, to avoid tax penalties when you file your return.

6. Itemizing Deductions

Step 4(b) of Form W-4 is crucial for itemizing deductions. Here, you can include deductions over the standard amount that affect W-4 withholdings.

Assessing these deductions might help you adjust your W-4 withholdings to avoid over-withholding during the year. First-time homebuyers may benefit from increased deductions on their W-4 withholding exemptions.

7. Specifying Additional Tax

Adding an excess amount to your W-4 withholdings in Step 4(c) will help you avoid taxes when you file. It customizes W-4 withholdings to your financial situation, protecting you during tax season.

8. Confirming Withholding Changes

Check your pay statements after submitting your amended W-4 form to ensure the changes were made. You may wait for a pay cycle or two for modifications.

Conclusion

Adjusting your W 4 withholdings is a tax planning chess move. Life moves, and so should your tax withholdings. Whether getting married, having a baby, or losing money, you should review your W 4 withholdings, like resetting your financial compass to avoid overpaying taxes or underspending your monthly budget.

By monitoring these changes, you're in control and ensuring every paycheck works for you rather than Uncle Sam. Grab your W 4 withholding exemptions, punch some numbers, and check your exemptions. This concerns protecting your money from tax surprises, not feeding the government.

What Do You Need To Know About Gross Leases?

Exploring the Role of Foreign Institutional Investors (FII)

Why Is Panama Considered a Tax Haven?

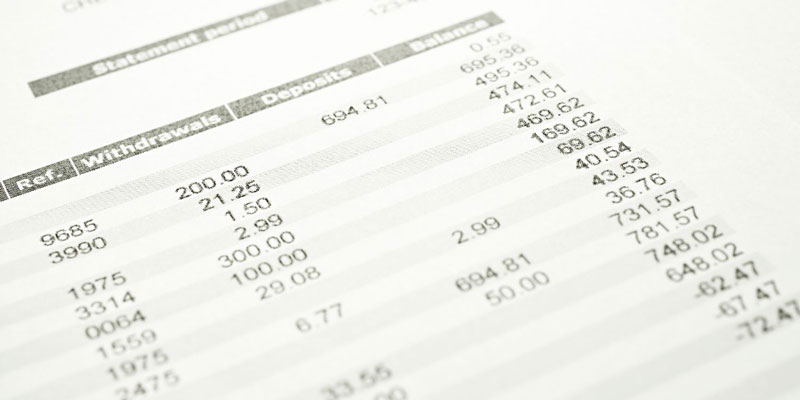

Things You Need to Know About an Account Statement

Top 5 Airlines Offering Refundable Plane Tickets

What Do You Know About Investing In A Cause?

What Is Bank Credit?

How To Cancel a Credit Card the Smart Way

Optimal Strategies for Utilizing $100K in Cash