Why Is Panama Considered a Tax Haven?

Nov 26, 2024 By Rick Novak

Are you looking to enjoy the attractive benefits of low or no taxation? What makes Panama one of the most popular tax havens in the world? As part of this blog post, we will take a good and informative look into why Panama is such an attractive place for those looking to benefit from lower taxes and greater financial freedom.

We’ll cover various wealth management options, investing opportunities, and legal arrangements that allow taxpayers with individual interests and businesses access reliable and safe ways to reduce their overall tax burden. So grab a coffee — it’s time to explore how investing in Panama can help you save on your taxes!

What is a Tax Haven

Tax havens are jurisdictions that offer low or no taxation, financial secrecy, and a range of other benefits to those looking to increase their financial freedom. These places often have relaxed registration requirements and easily incorporate offshore companies, allowing businesses and individuals to reduce their tax bills while still conducting business in a secure environment.

How Does It Work

At the heart of Panama's reputation as a tax haven is its “free zone” system. This system allows people and businesses to take advantage of various tax benefits, including income, capital gains, and value-added taxes (VAT). The main idea behind the free zone system is that foreign investors don’t have to pay any taxes on their profits or investments if they keep their funds within the free zones.

This allows businesses to reduce their overall tax burden and keeps more profits in their pockets. Businesses can also benefit from the country's low corporate tax rate, which is a flat 25%. On top of this, Panama has no restrictions on foreign exchange or the repatriation of capital. This means businesses and individuals can move their funds around freely without worrying about being taxed or restricted.

Benefits of Panama as a Tax Haven

Panama is at the forefront of the tax haven market for many reasons. Here are benefits that make Panama one of the most attractive choices for those seeking to reduce their overall tax burden:

Low or no taxation - One of the main advantages of Panama as a tax haven is its low or no taxation system. Unlike high-tax countries like the UK, the US, and other European countries, Panama has a low or no taxation system that allows businesses and individuals to save on their overall taxes.

Offshore banking - Another benefit of Panama's tax haven status is its access to offshore banking services. With this type of service, residents of Panama can open offshore bank accounts and enjoy a safe and secure way to store their money without worrying about high taxation rates.

Offshore trusts - Panama also offers offshore trusts, which are trust funds set up specifically for those wishing to reduce their tax burden. This type of trust is ideal for individuals or businesses looking to move their funds and assets overseas while still being able to access them when needed.

Privacy and confidentiality - Panama also offers individuals, businesses, and families privacy and confidentiality of their financial matters. This means that information regarding offshore accounts, trusts, and other financial transactions can remain confidential, allowing taxpayers the peace of mind that their financial affairs are secure and safe.

No inheritance or estate taxes - Panama does not have any inheritance or estate taxes, meaning that those who wish to pass on their wealth to their heirs can do so without worrying about high taxation rates.

Low corporate tax rate - Panama also has a low corporate tax rate of just 25%, meaning that businesses can take advantage of this rate to save on their overall taxation.

Free trade zones - Finally, Panama is home to many free trade zones, which are areas where companies and businesses can operate without worrying about high taxes or restrictions. This makes it attractive for those looking to set up businesses and invest in a low-tax environment.

The Advantages of Investing in Panama

Panama is often considered a desirable tax haven for its attractive benefits, including low or no taxation; reliable and safe ways to reduce overall taxes; and access to wealth management options, investing opportunities, and legal arrangements that are accessible to both individual taxpayers and businesses.

While other countries have higher tax rates or complex bureaucratic processes for reducing taxes, Panama is an attractive choice for those looking to get the most out of their investments.

One of the primary advantages of investing in Panama is its status as a tax haven. Panama has no official income tax, and instead, it relies on taxes from other sources such as real estate, corporate profits, and capital gains. This means that individuals and businesses investing in Panama can enjoy lower taxation benefits than in other countries.

In addition to its low tax rates, Panama also offers a wide range of wealth management options, investment opportunities, and legal arrangements that are accessible to both individual taxpayers and businesses alike. For instance, individuals can choose from various asset protection structures such as trusts, corporations, and foundations.

How to Plan Your Finances with an Experienced Professional

No matter your financial objectives and ultimate goals, planning your finances with an experienced professional in Panama is strongly advised. A qualified accountant can help you stay on top of things and understand the local tax regulations to ensure that you remain compliant while enjoying the benefits of a lower overall tax rate.

Moreover, an experienced accountant in Panama can provide valuable insight on how best to reinvent or improve your business structure within the tax haven’s jurisdiction. Helping you reach your financial objectives securely and effectively, without investing in costly investments or paying unnecessary taxes.

FAQs

How do people live in Panama tax-free?

People who choose to live in Panama can benefit from its advantageous tax policies. Panama has no capital gains tax, no inheritance tax, and a flat income rate of just 25%.

What is the biggest tax haven in the world?

The biggest tax haven in the world is Panama. It offers some of the most attractive benefits to taxpayers, including no capital gains tax and a flat income rate of 25%. Panama also has an advantageous legal framework that allows businesses to take advantage of reliable and safe ways to reduce their overall tax burden.

What kind of investments are available in Panama?

Panama has many investment opportunities, including real estate and business investments. Panama also offers some of the most advantageous tax regimes in the world, allowing both individual and business investors access to reliable and safe ways to reduce their overall tax burden.

Conclusion

It is clear why Panama is such an attractive option for those seeking a tax haven. With its low taxes, lack of financial transparency laws, and wealth of financial institutions, Panama offers a unique combination of advantages that other countries cannot match.

From individual investors to multinational corporations, Panama provides an environment in which tax rates are kept to a minimum. Most importantly, while taking advantage of this unique set of benefits, businesses and individuals can rest assured that they are engaging in legitimate offshore activities and respecting their duty to pay the required taxes in their home country.

The Best Brokers for Penny Stocks

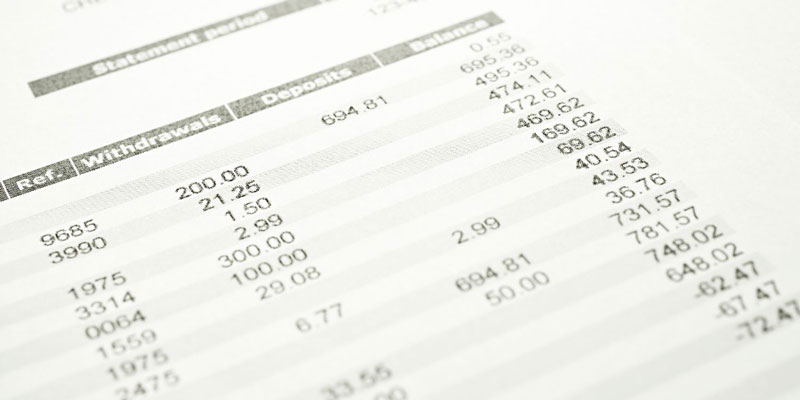

Things You Need to Know About an Account Statement

Top 5 Airlines Offering Refundable Plane Tickets

Child and Dependent Care Credit: Definition, Who Qualifies

Understanding Open Interest: What it is and How it Affects Trading

Best Credit Monitoring Services

How To Figure Out The Deductible For Hurricane Insurance

Optimal Strategies for Utilizing $100K in Cash

What’s the Difference Between Index and Stocks Funds?