How To Compare HSA Providers For Maximum Savings?

Jan 01, 2025 By Kelly Walker

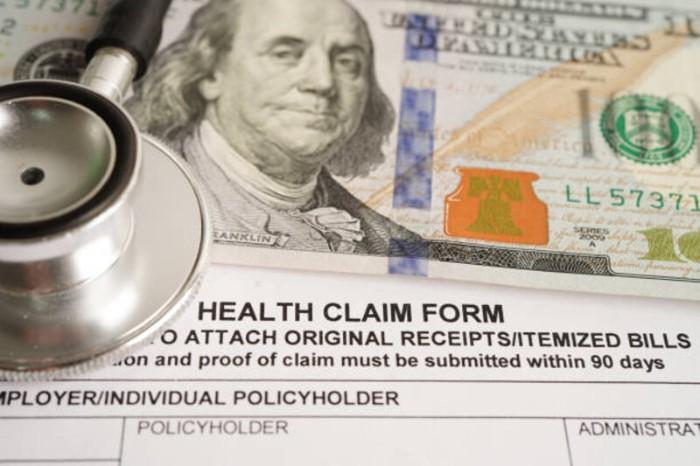

Health Savings Accounts (HSAs) are becoming increasingly popular to save on healthcare costs while providing tax advantages. With so many HSA providers available, knowing which suits you and how to compare them for maximum savings can be challenging. This guide will provide an overview of the different types of HSA providers and explain the key factors you should consider when choosing the best provider for your needs. We'll also discuss strategies for maximizing your savings with your chosen HSA provider. By understanding these tips and tricks, you can make informed decisions about how to get the most out of your health savings account.

Understand the basics of a Health Savings Account (HSA)

Before comparing HSA providers, it's essential to understand the basics of a Health Savings Account. An HSA is an IRS-qualified savings account that allows you to set aside pre-tax dollars for medical expenses. Your HSA can pay for healthcare costs such as doctor visits, hospital stays, and prescriptions. HSA contributions are usually tax-deductible, and funds withdrawn for qualified medical expenses are not taxed.

Research different HSA providers and their features

Once you understand the basics of an HSA, it's time to start researching different HSA providers and what they offer. As you compare different companies, take into account factors such as fees, investment options, customer service, and other features that may be important to you. Read each provider's terms and conditions to understand what you are signing up for.

Compare fees, interest rates, investment options, customer service ratings, and other factors

When comparing different HSA providers, there are several factors to consider. Be sure to compare fees, interest rates, and investment options, as these will impact your overall savings. Prices vary significantly from provider to provider, so it's essential to understand precisely what you're paying for. Additionally, look for providers offering a wide range of investment options to diversify your portfolio and maximize returns. Finally, research each provider's customer service ratings to ensure they are reliable and provide quick responses to any questions or concerns.

Maximize your savings with strategies such as automatic contributions

Once you've chosen an HSA provider, there are several strategies you can use to maximize your savings. One of the best strategies is to set up monthly automatic contributions from your paycheck or bank account. This will allow you to use compounding interest and quickly grow your savings. Additionally, take advantage of any employer-matching contributions available through your HSA provider. Finally, consider investing a portion of your HSA funds for long-term growth.

Consider if you need additional services like online banking or mobile apps for convenience

When comparing HSA providers, consider if you need additional services such as online banking or mobile apps. These features make managing your HSA more convenient and allow you to access your funds quickly when required. Additionally, some providers offer discounts for more significant contributions, so inquire about any special offers that might apply to you.

Calculate which provider offers the best value for your needs

Once you have all the information you need, it's time to calculate which provider offers the best value for your needs. Consider fees, interest rates, investment options, customer service ratings, and additional services to determine the right choice. By taking these steps and researching each provider thoroughly, you can ensure you get the most out of your HSA and maximize your savings.

Read reviews from current customers to get an idea of their experience with each HSA provider

One of the best ways to gauge an HSA provider is to read reviews from current customers. Ask friends and family for their opinion, or look at online review sites to understand their experience with each provider. Contact customer service representatives directly if you have any questions or concerns. These steps will help you decide and choose the right HSA provider for your needs.

Make sure you understand all the terms and conditions before signing up with any provider

Before signing up with any HSA provider, please read and understand their terms and conditions. Be aware of any hidden fees or restrictions that may apply to your account. Additionally, be sure to check for additional perks or features such as discounts on contributions, employer matching funds, or special offers for more significant balances. Understanding all the details will allow you to decide and select the best HSA provider for your needs.

Set up your account and start saving!

Once you've chosen a provider, it's time to set up your account and start saving. Most providers offer simple online sign-up processes that make getting started easy. Many providers also provide helpful tutorials and resources to help you understand how an HSA works and how to manage your account effectively. With the right provider, you can begin taking advantage of the many benefits that an HSA offers and maximize your savings.

Conclusion

Comparing HSA providers can seem daunting, but with the proper research and planning, it can be a straightforward process. Consider factors such as fees, services offered, customer service ratings, and additional perks to ensure you get the most out of your HSA. Additionally, read reviews from current customers and contact customer service representatives to ask any questions. Once you've found the perfect provider, set up your account and save.

FAQs

How can I compare HSA providers?

When comparing HSA providers, consider fees, services offered, customer service ratings, and additional perks. Read reviews from current customers and contact customer service representatives to ask any questions.

What should I look for in an HSA provider?

Look for a provider that offers competitive fees, a wide range of services and investment options, high customer service ratings, and additional perks such as discounts on contributions or employer matching funds.

Child and Dependent Care Credit: Definition, Who Qualifies

HSBC Premier World Mastercard Credit Card Review

Original Issue Discount (OID): What is it?

Why Is Panama Considered a Tax Haven?

What Do You Know About Investing In A Cause?

Understanding Open Interest: What it is and How it Affects Trading

Optimal Strategies for Utilizing $100K in Cash

Active vs. Passive Investing

Top 10 S and P 500 Stocks by Index Weight